List of Most Overvalued Stocks

| Company Name | Price | Volume(L) |

|---|

Last updated at

Open Free Demat Account!

Enjoy ₹11 Brokerage on Stocks Delivery

Equity, F&O and

DP Charges

| Company Name | Price | Volume(L) |

|---|

Last updated at

Enjoy ₹11 Brokerage on Stocks Delivery

A stock that is trading over its inherent worth is said to be overvalued. This happens when market enthusiasm or speculation favours the stock. It helps drive prices up beyond the levels supported by the fundamental factors of a company. This includes things like earnings, potential growth, or asset base.

Investors would normally refer to metrics like the price-to-earnings ratio to identify overvaluation. However, it is quite risky to buy the most overvalued stocks since the price could start correcting downwards and might lead to losses for you.

Here are four key points for determining overvalued stocks

Financial experts go through a stock's value and earnings per share. A high P/E in comparison to historical averages or industry peers may be a sign of overvaluation. Hence, you must consider both trailing and forward P/E ratios of overvalued stocks.

Experts also estimate future cash flows and discount them to present value. If the stock price exceeds this calculated intrinsic value, they consider it among the most overvalued stocks in India. Hence, DCF requires careful assumptions.

This is when you evaluate the stock price against revenue and book value. High ratios compared to peers or historical norms can suggest that it is one of the most overvalued stocks in India. It can be especially useful for unprofitable or asset-heavy companies.

If there are any unrealistic growth projections, it can then get the prices beyond fundamental values. Hence, you must consider analyst opinions and compare growth assumptions to realistic potential.

The stock’s dividend yield, compared to its historical average and industry peers, is also something that you must pay attention to. Unusually small profits are an indication of overvaluation. This is especially true for mature companies with consistent dividend histories. So, consider payout ratios and dividend growth trends in the overvalued stocks list.

Another way is to compare the stock’s valuation metrics to those of similar companies in the same industry or sector. Significant premiums without good reasons are an indication that it is among the most overvalued stocks.

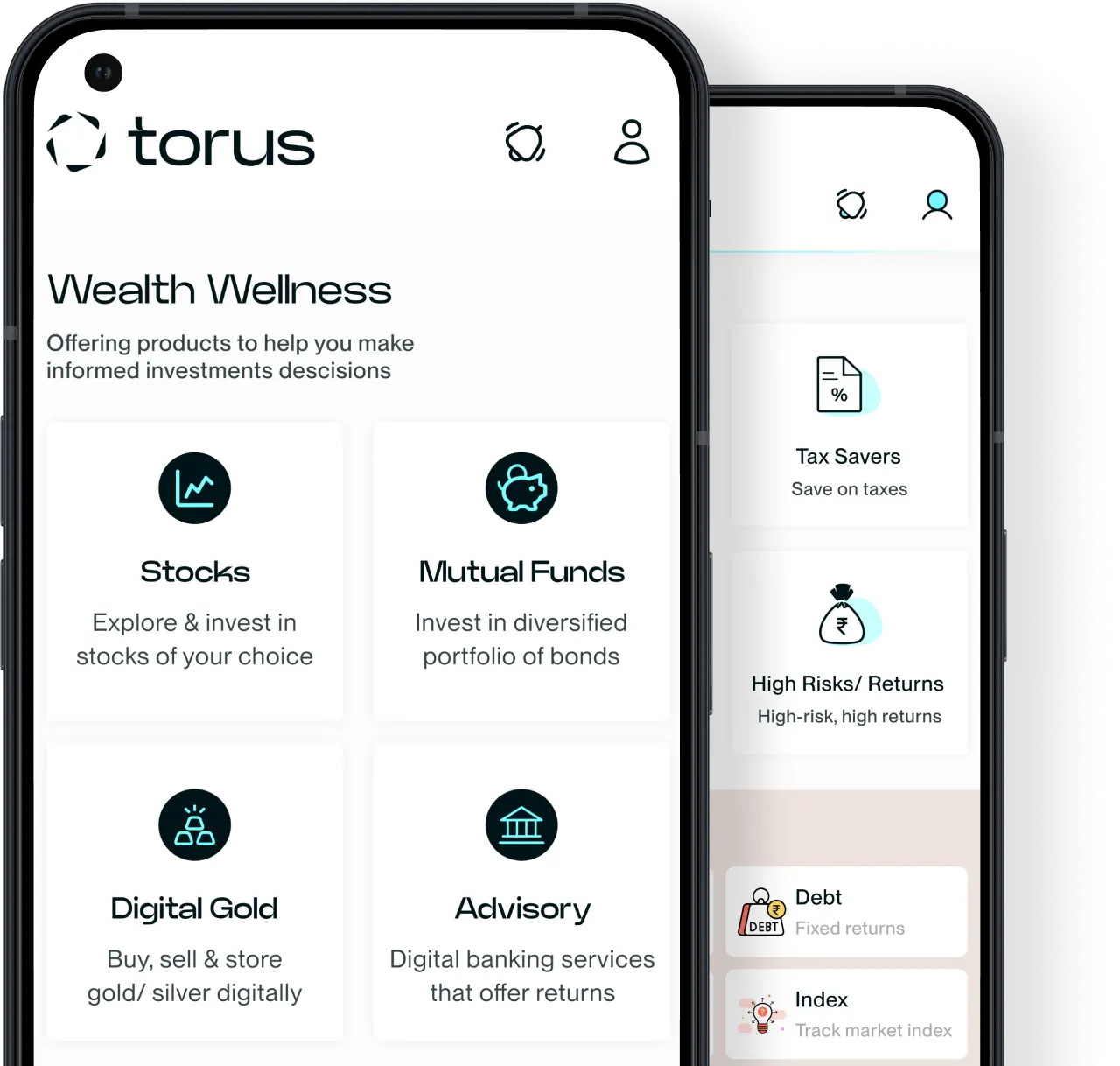

Login to your Torus Digital Account and deposit funds using a variety of secure payment options like bank transfers or cards.

Navigate to the Market section and select Most Overvalued Stocks from the filter.

Analyze the stock performance by reviewing price trends, company fundamentals, and recent news.

Shortlist the stocks that fit your investment goals.

Place your order by selecting the stock, entering the quantity, and choosing your order type (Market or Limit).

Confirm your trade and monitor your investments from the portfolio section.