List of Most Undervalued Stocks

| Company Name | Price | Volume(L) |

|---|

Last updated at

Open Free Demat Account!

Enjoy ₹11 Brokerage on Stocks Delivery

Equity, F&O and

DP Charges

| Company Name | Price | Volume(L) |

|---|

Last updated at

Enjoy ₹11 Brokerage on Stocks Delivery

Undervalued stocks are those trading below their perceived true worth. This is based on fundamentals such as earnings, dividends, and growth potential. Investors look for such undervalued stocks list because they believe the stock is being mispriced by the market.

Hence, believe there is a potential profit when the market corrects itself. A common strategy, better known as value investing, involves analysing financial metrics like the p/e ratio. Doing so can help you identify the most undervalued stocks in India that are priced lower than their actual worth.

Here are six points on determining undervalued stocks:

A low P/E compared to industry peers or historical averages can be taken to identify the most undervalued stocks. Hence, you must consider both trailing and forward P/E ratios. This is because they account for both company growth prospects and market conditions.

If a stock has a P/B ratio below 1 or significantly lower than industry averages, means, it is among undervalued stocks. This is a method particularly useful for asset-heavy industries. Consider the quality of assets and return on equity.

If a company's intrinsic value calculated through DCF exceeds its current market price, it can be one of the most undervalued stocks. Hence, paying careful consideration to growth rates, discount rates, and future cash flows is crucial.

High dividend yields compared to peers or past results can indicate undervaluation. However, ensure the dividend is sustainable by looking at the payout ratio and the company's financial health.

A PEG ratio below 1 suggests a stock may be undervalued relative to its growth rate. This metric is particularly useful for comparing growth stocks within the same industry. It is also useful to determine the most undervalued stocks in India.

Look for companies with valuable assets not fully reflected in the stock price. This could include real estate, intellectual property, and subsidiaries. It could also include any cash reserves that exceed the company's market capitalization.

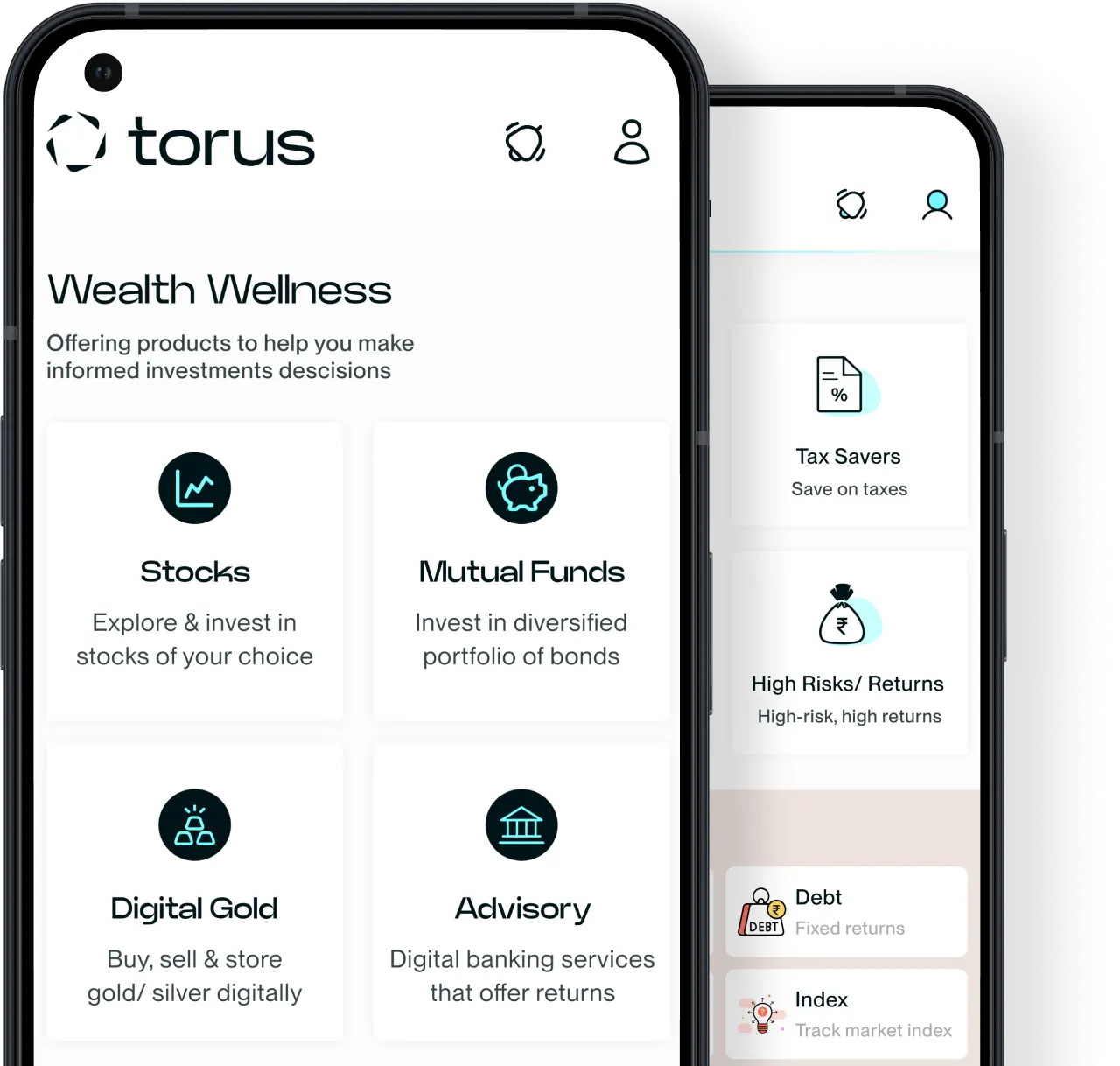

Login to your Torus Digital Account and deposit funds using a variety of secure payment options like bank transfers or cards.

Navigate to the Market section and select Most Undervalued Stocks from the filter.

Analyze the stock performance by reviewing price trends, company fundamentals, and recent news.

Shortlist the stocks that fit your investment goals.

Place your order by selecting the stock, entering the quantity, and choosing your order type (Market or Limit).

Confirm your trade and monitor your investments from the portfolio section.